The Facts About Private Wealth Management Canada Uncovered

What Does Lighthouse Wealth Management Do?

Table of ContentsSee This Report about Lighthouse Wealth ManagementSome Known Incorrect Statements About Investment Consultant What Does Financial Advisor Victoria Bc Do?Not known Details About Financial Advisor Victoria Bc Tax Planning Canada Things To Know Before You Get ThisLighthouse Wealth Management Can Be Fun For Everyone

“If you're to purchase an item, say a television or a computer, you'd need to know the requirements of itwhat are its elements and what it can create,†Purda details. “You can contemplate purchasing economic advice and support in the same way. Individuals need to know what they're purchasing.†With financial information, it's vital that you just remember that , the item isn’t securities, stocks and other investments.it is things like cost management, planning for your retirement or reducing debt. And like getting some type of computer from a trusted business, people wish to know these are generally buying economic information from a trusted expert. One of Purda and Ashworth’s most fascinating conclusions is about the charges that financial coordinators demand their clients.

This conducted genuine it doesn't matter the fee structurehourly, percentage, possessions under management or flat rate (in the learn, the buck value of costs was the same in each instance). “It however comes down to the worthiness idea and anxiety throughout the customers’ component that they don’t determine what they might be getting in exchange of these costs,†claims Purda.

The Ultimate Guide To Tax Planning Canada

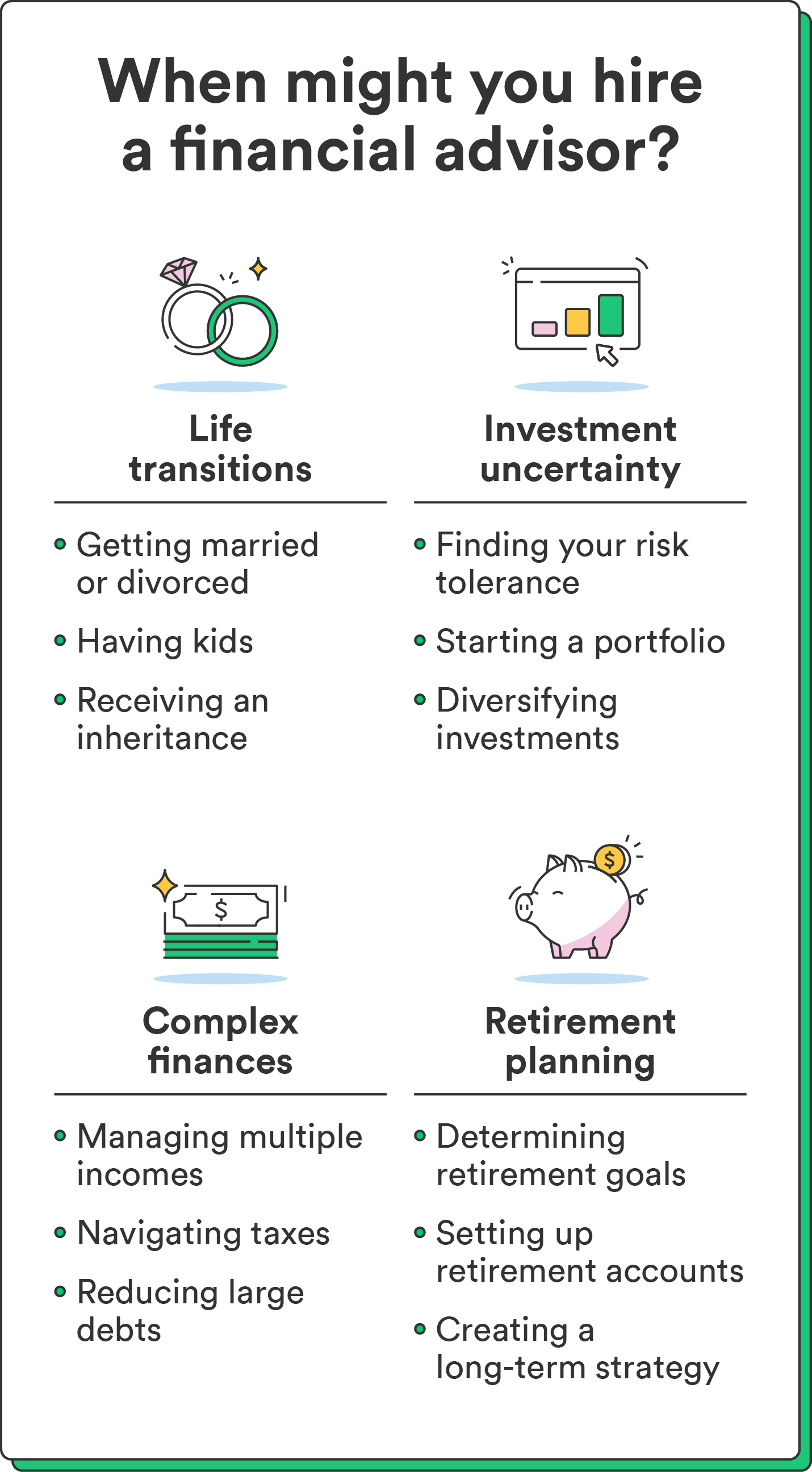

Tune in to this article whenever you listen to the word economic specialist, what pops into the mind? A lot of people contemplate an expert who is going to give them monetary guidance, especially when you are considering trading. That’s a great place to start, however it doesn’t paint the entire picture. Not even near! Monetary analysts might help people with a bunch of additional money goals too.

An economic expert makes it possible to create wide range and protect it for any long lasting. They can estimate your own future financial requirements and program strategies to stretch the retirement cost savings. Capable additionally counsel you on when to begin tapping into personal safety and ultizing the amount of money in your retirement reports to help you avoid any terrible penalties.

Rumored Buzz on Tax Planning Canada

They may be able make it easier to determine just what common funds are right for you and demonstrate how to handle and then make more of financial investments. Capable also assist you to comprehend the dangers and what you’ll need to do to obtain your goals. An experienced financial investment professional will also help you stay on the roller coaster of investingeven once opportunities simply take a dive.

They could provide guidance you ought to make plans to help you make sure that your wishes are carried out. And also you can’t put an amount tag regarding the peace of mind that accompanies that. Based on research conducted recently, the common 65-year-old few in 2022 will need about $315,000 saved to cover health care costs in retirement.

Independent Investment Advisor Canada Things To Know Before You Get This

Now that we’ve gone over what economic experts perform, let’s dig in to the varieties. Here’s good principle: All monetary coordinators tend to be economic experts, although not all advisors are coordinators - https://www.bitchute.com/channel/rhnBTeLFYHxu/. A monetary planner centers on helping folks develop plans to achieve long-lasting goalsthings like beginning a college fund or preserving for a down cost on a house

So how do you know which financial specialist suits you - https://dribbble.com/lighthousewm/about? Here are some actions you can take to be certain you’re hiring suitable person. Where do you turn once you have two poor choices to choose from? Effortless! Discover more options. The greater amount of choices you really have, the much more likely you're to help make check over here a decision

Some Known Details About Independent Financial Advisor Canada

Our Smart, Vestor program makes it simple for you by revealing you up to five financial experts who are able to last. The good thing is actually, it's totally free attain connected with an advisor! And don’t forget to come calmly to the meeting ready with a list of questions to inquire about so you're able to determine if they’re a good fit.

But listen, because a specialist is smarter compared to ordinary bear does not let them have the authority to tell you what direction to go. Occasionally, advisors are loaded with on their own simply because they do have more levels than a thermometer. If an advisor begins talking down to you, it's time to suggest to them the doorway.

Keep in mind that! It’s essential that you and your monetary consultant (whoever it ultimately ends up becoming) are on exactly the same web page. Need an expert who has got a long-lasting investing strategysomeone who’ll motivate one hold trading consistently perhaps the market is up or down. investment consultant. You don’t need make use of somebody who forces one to purchase a thing that’s also risky or you are uncomfortable with

Things about Independent Investment Advisor Canada

That combine provides you with the variation you should successfully spend for all the long term. While you research monetary experts, you’ll probably stumble on the expression fiduciary obligation. All of this means is actually any advisor you employ must work in a fashion that benefits their particular customer and never their self-interest.